The full form of FCRA is Foreign Contribution Regulation Act. The Foreign Contribution Regulation Act of 1976 is a government law that grants the receipt of foreign contributions or assistance to Indian areas from outside India.

Many funds are released by the Indian government and foreign funding agencies for the benefit of the underprivileged. These funds are distributed on a regular basis to non-profit organizations that have received an FCRA certificate.

When you want to attract foreign donations, FCRA Registration will help you. If an NGO gets itself registered under section 80G & 12A then the person or the organization making a donation to the NGO will get a deduction of 50% of the donation amount from taxable income.

Registration for 80G Certificate

- NGO can avail of income tax exemption by getting itself registered and fulfilling certain other formalities, but such registration does not provide any benefit to the person making donations. To provide income Tax benefits to the “donors”, all NGOs must apply for 80G & 12A certification.

- If an NGO gets itself registered under section 80G & 12A then the person or the organization making a donation to the NGO will get a deduction of 50% of the donation amount from taxable income,

- An NGO is applicable for government funding if it is registered under 12A.

- A newly registered NGO can also apply for 12AG registration.

- An NGO does not have to pay tax for the entire lifetime if it gets registered under section 80G & 12A.

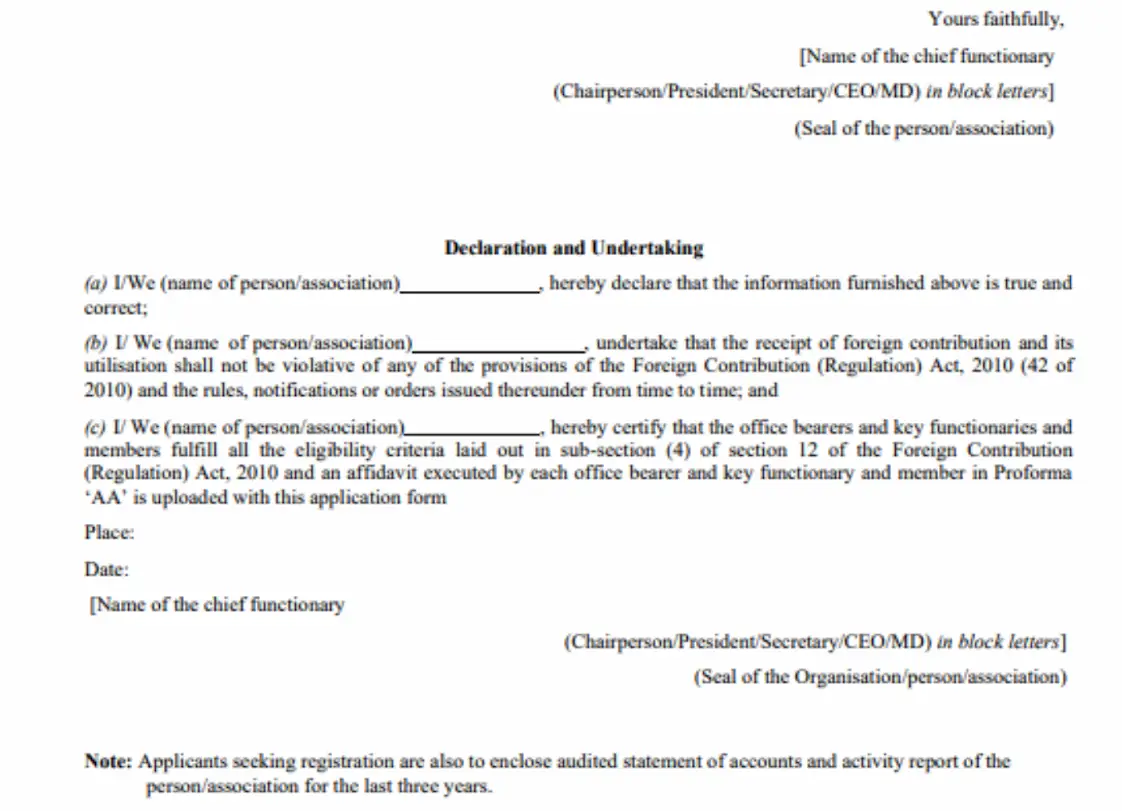

- FCRA registration is required to attract donations outside India; The NGO must be registered under the provisions of the foreign contribution regulation act, 1976.

- For FCRA registration an NGO must have completed three years of operations. FCRA Registration is granted by the Ministry of Home Affairs, Govt. of India.

FCRA Registration is required for your NGO to attract foreign donors.

-Limited.webp)

-Private-Limited.webp)

-Private-Limited.webp)

Pvt.Ltd.webp)

-Private-Limited.webp)